Valor View – NG – Dec 18 – Weather Plays & Holiday Distractions

Market Overview

- War and weed is in the air to keep you distracted from the E files

- The distractions also include announcement of "Hunger Games"

- Similarly, Natty market tried to be distracted with some weather coming back story, but traders are not having any of it

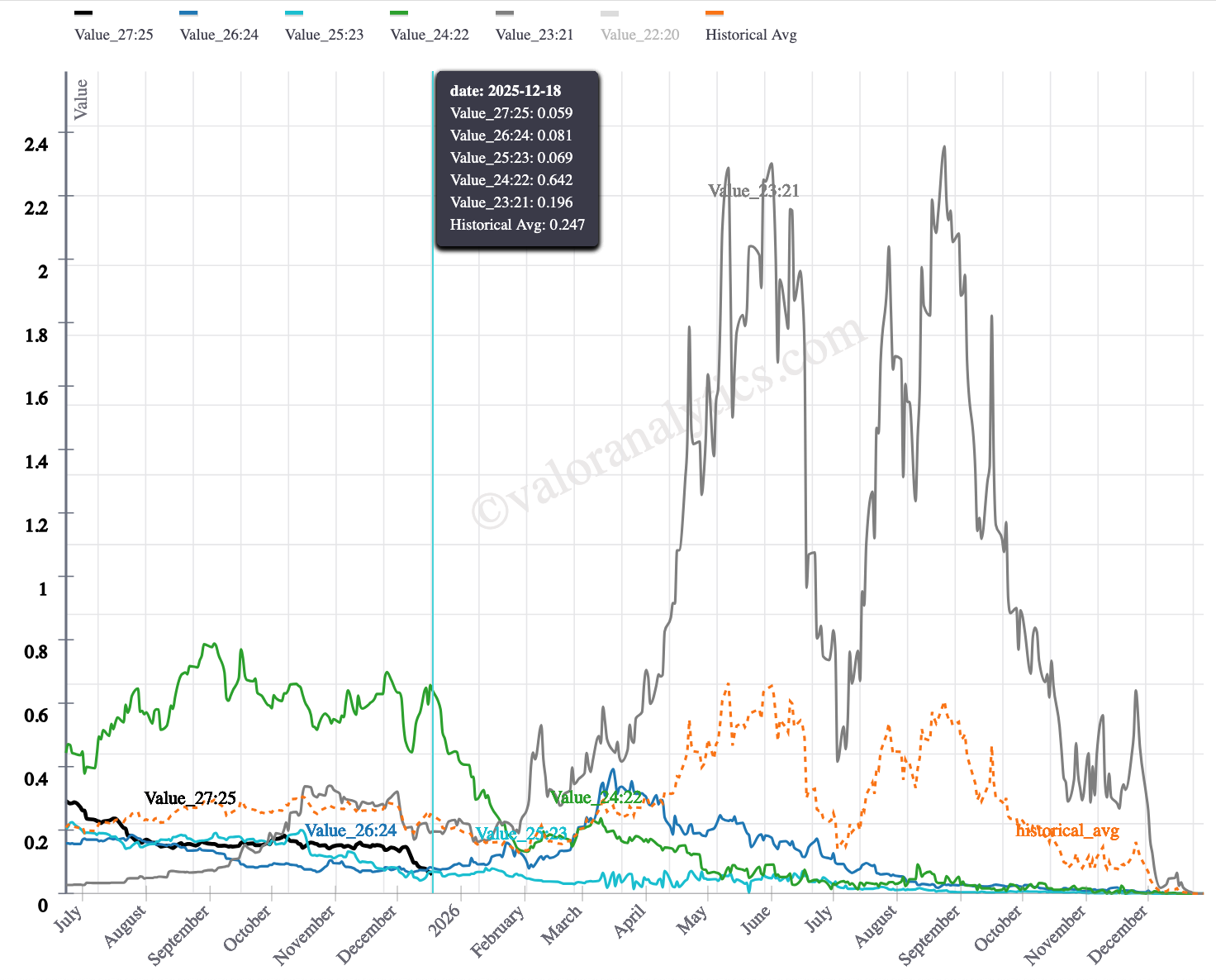

- Even with the rally mostly FG was trying to stay bid, but HK and summer aren't really in the mood for a bid

- Puts on strips like HK (Mar-May) tell you market cares more about the potential for weakness in low demand and high production, rather than FG

- This is a great comment that expresses the rush for buy more weakness

Key Trades

- Mar/Apr -0.05 put traded 2.7 cent 8,000x and that's the most brilliant trade of today. Mar/Apr flat put traded 0.054

- Mar/Apr 0/-0.10 1x2 ps were also active for around 2.7c~

- Mar-Dec 3.50/3.25 put spread traded 11.2 cent. Idea is to just leave the Jan-Feb in case weather returns, but the downside beyond that is a certainty according to this market

- Apr/Oct CSOs got active like clockwork too

- J/V -0.75/-1.00 put spread traded 0.035

- J/V -1.00 put traded 0.022

Options Flow

- Call selling is still going on

- Nov 4.00 calls got sold for around 52c

- I can't believe it 35-36 vols of Nov-Dec

- Check out the move in X and the daily BE

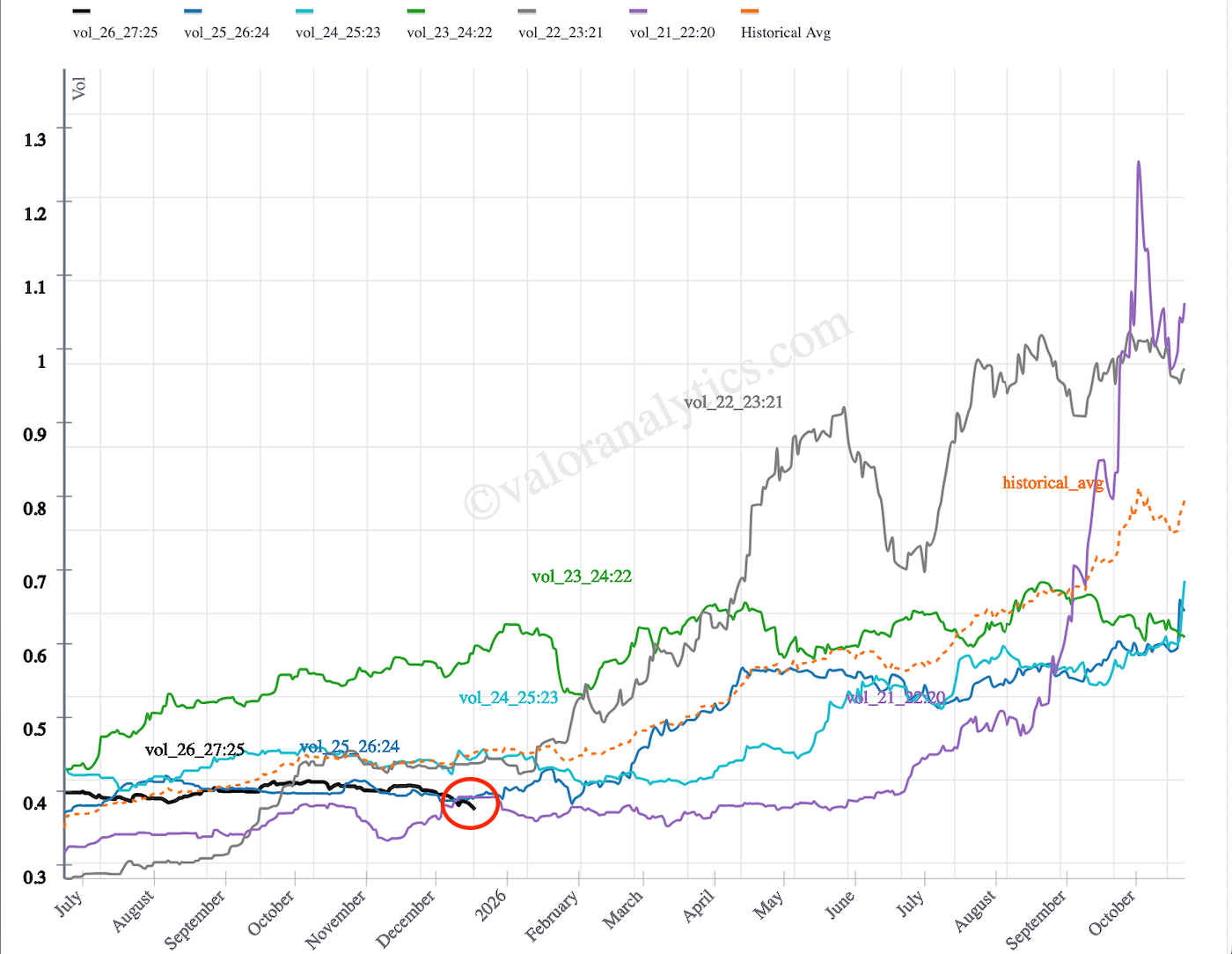

Vol Analysis

- Red winter vol is already making new lows

- Vol traders keep eyeing it, bu they all know there is pain on it before any gains

- Your Ususal Suspects are selling Jan 27 7.00 calls for 36 something cents

- Mar'27 calls still have some bid interest. It is the exact playbook from a year ago

- Jan '27 calls 10.00 calls are down to 5~ something cents. Already lowest in 5 years

Outlook

- This is a very weird behavior by the market. Seems early and seems to have full faith in not much cold coming back and high EoS

- JV 2.5/2.25 1x2 put spread traded 4 tics. Makes me cringe

- But then, I see Cal '28 2.25/2.00 1x2 put spread trading -1.9c which made me shed a tear. Is this what trading is going to be all about?

- Q2 5.00 calls were hit for 5.9c

- Essentially, nothing bullish on the horizon

- But, if some decent cold comes back, will there be another round of stop outs in the $1 range?