Valor View – NG – Jan 30 – 50 Cent Rally & Weekend Weather Risk

Market Overview

- And... just like that a 50 cent move

- Market is now running in scared, what ifs mode

- What if we get more weather with no SALTs or low SALTs

- No one wants to go short over the weekend. Not outright anyway

- Especially when everyone is scratching their head about why LNG didn't shut down more with $30-$50 cash

- March vol up 23%, but puts barely sold. How does that happen? Tells you no one wants to be outright short, but realized we have room to go down if weather fails

- 100 vol March puts will not pay though. We could be down $1 next week and vol will still come off 40%. Run that analysis before you buy any March puts outright. Ratio spreads will outperform and are very very cheap

Price & Vol Analysis

- This are great charts to see what happened in the market today

- Futs and atm vol were up just one for one

- But, interesting divergences in Mar and JV positioning

- March calls got bid (but not overtly so), most of the March up move was just in ATM. Relatively, I will call the call move weak. Still went higher, but JV call skew actually went down

- I guess the assumption is either weather or producers will call a top on JV?

- On the put side, JV puts went bid too

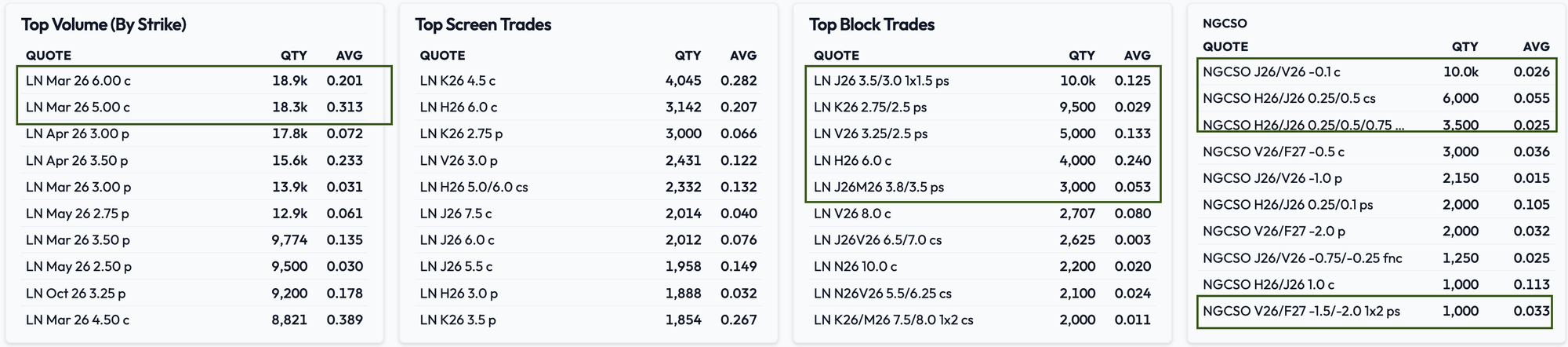

Key Trades

- Same thing shows up on the Trades also

- March 5.00 and 6.00 calls the top trade

- However, look at the block traders which almost matched screen on volumes

- Apr 3.50/3.00 1x1.5 put spread

- May 2.75/2.50 put spread

- June 2.50/2.00 1x2 put spread 0.013

- Oct 3.25/2.5 put spread

- Q2 3.80/3.50 put spread

Calendar Spreads & CSOs

- Similar positioning in CSOs as well

- With such high volatility H/J CSO call spreads are extremely cheap

- Mar/Apr 0.25/0.50 cs 0.055

- Mar/Apr 0.25/0.50/0.75 cfly 0.025

- Oct/Jan spread is still going for the widening trade

- Oct/Jan -1.50/-2.00 1x2 put spread 0.033

- Oct/Jan -2.00 put 0.032

Vol & Outlook

- As has been the norm lately, with interest on both sides, the range is very wide and vol keeps rallying

- I wish I had bought some of those Jan'27 6.00 calls for 26 cents. Where is that guy now?

- Today, Mar'27 20.00 calls got quoted around 1.5-2.00 cents

- But, sure there is no bid for any vol beyond that JV'27. Cal'28. Dirt cheap

- The guys who are long it keep quoting to see if there is any bid, but there isn't any still

- That's the problem with back vol, you could be sitting on dirt cheap stuff, but if no one wants it or dumb producers offer more. Nothing you can do

- I mean the dumb ones, not the ones who are my clients 😄

- Silver had no buyers today or Gold. Let's hope weather stays in gas