Natural Gas Weekly Recap: The Weather Rug Pull & Vol Aftermath | Feb 1-5, 2026

NG's wild week - an 80+ cent sell-off, March vol crushed 32%, and the winter rally narrative gets tested. Free weekly market recap.

The Big Picture

What a week in natural gas. On Friday, some traders were saying we wouldn’t see $2 this year. By Monday, many of those same traders were wishing they were farmers.

This winter’s weather story has been a recurring pattern of cold forecasts turning warm, but the one time it didn’t flip — over the long weekend — cash went to $50+ and futures past $7. That left scars. Heading into this past weekend, the market was in overbought territory with CTAs max long, and traders were nervous about getting caught again. Weather did what it’s been doing all winter and flipped the maps warm.

The result was a massive unwind. JV26 traded 500+ lots a day on screen in an unprecedented 80+ cent sell-off on the strip. Over 50,000 TAS contracts traded, followed by a rally into the close as stop-outs and CTA repositioning created violent two-way action. Day-to-day volatility has been so intense that it’s hard to take a step back and see the bigger picture.

Key Themes This Week

1. The $5 Strike Story

Before the long weekend, $5.00 was identified as the highest open interest strike — the max pain level. At that point, the $5 options were trading at just 2 ticks. Weather continued to add cold, and the market started talking about the biggest storage draw ever and what price would be needed to fix the imbalance. When NG hit $5, those 2-tick options had reached 50 cents. The OI on Feb $5 and $6 calls came down as both longs and shorts closed positions, taking profits and losses respectively. Just before February OPEX on 01/26, activity in Feb $7 calls picked up — but CME had multiple problems on expiration day, and those $7 calls never went in the money.

2. The Sell-Off & Vol Repricing

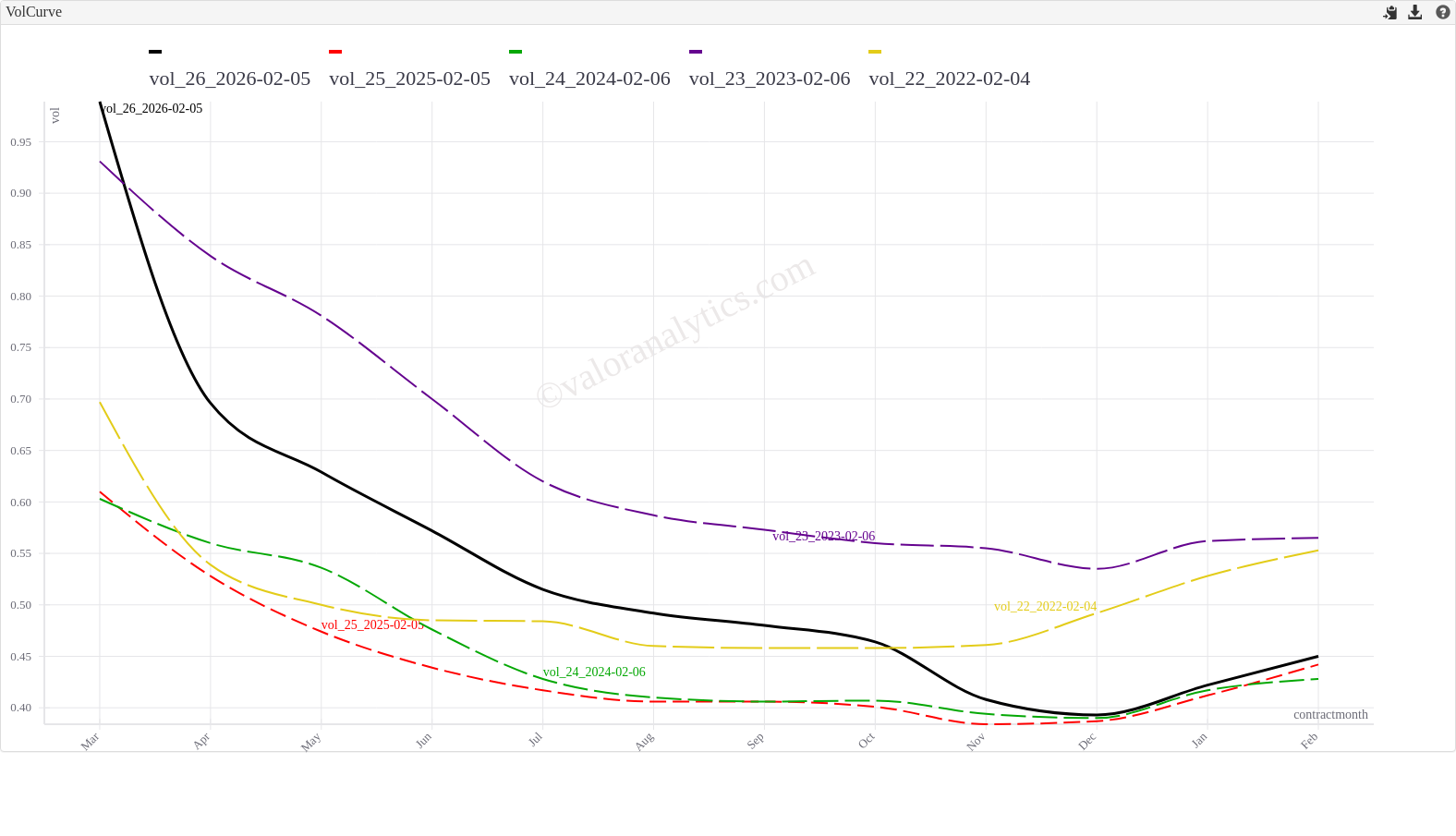

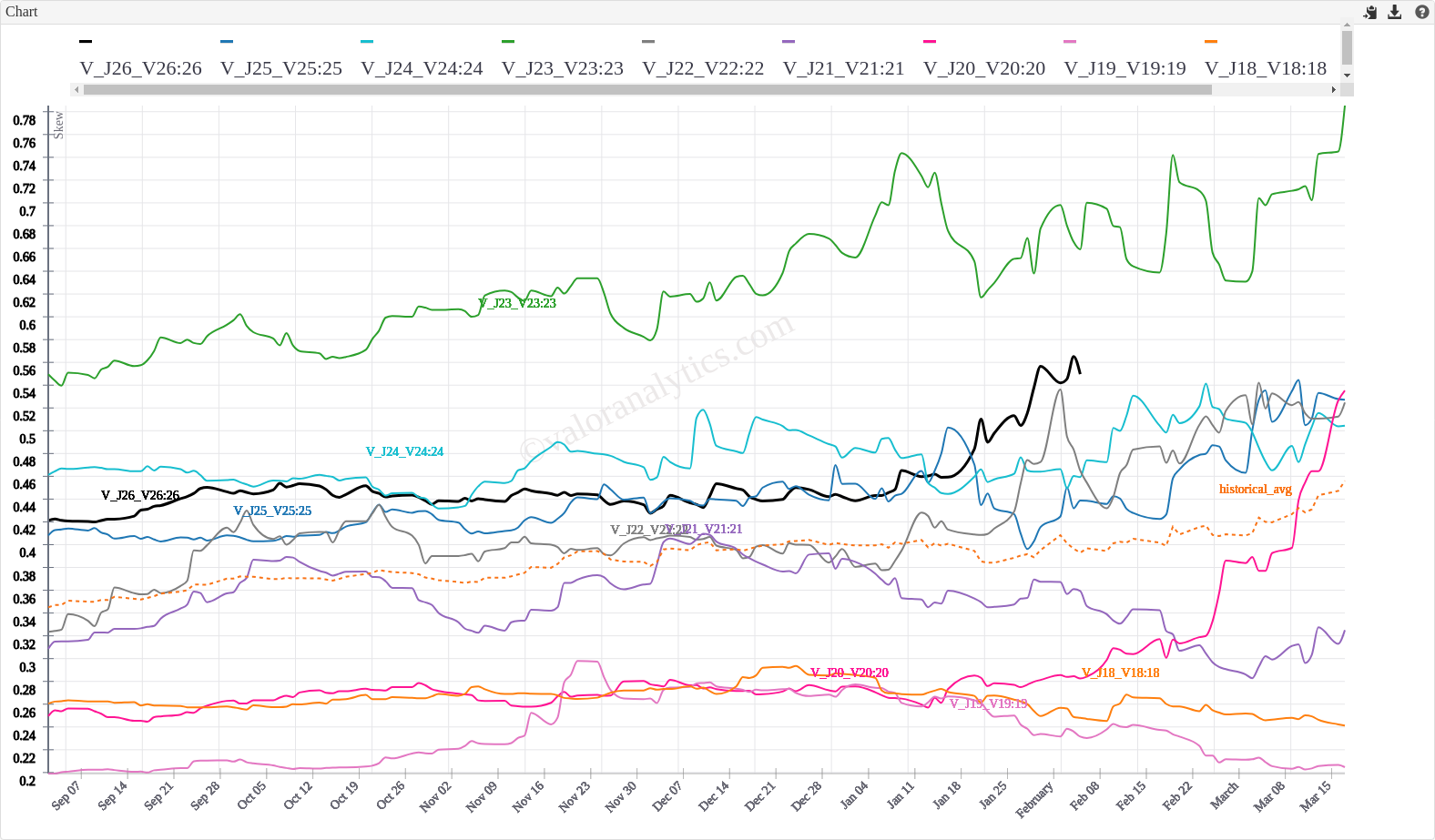

March implied volatility sold off roughly 32% from its highs. The move down in price was much larger than anyone expected. On the skew side, the dynamics are nuanced — the 4.50 calls that were near ATM on Friday ended up at roughly 20 delta after the sell-off, gaining vol from steeper skew even as ATM vol and call skew compressed. Looking at vol changes by strike rather than delta tells a different story: put vol declined while $4-$6 calls actually gained. In fact, May through August calls were making new highs, likely driven by the lower end-of-season storage projections.

3. Options Flow: From Calls to Puts

The shift in positioning was visible in real-time. Early in the week, March $5.00 and $6.00 calls were the highest volume contracts — a change from the usual dominance of March $3.00 puts. Mar/Apr $1.00 call spreads were back at 3.5 cents, and V/F -$0.75 calls traded around 5.5 cents.

By mid-week, the EIA report came in slightly bearish (1 Bcf higher draw than expected at 359 Bcf), reversing the previous day’s rally. Q2 put flies (3.00/2.75/2.50) started trading at 3 cents. By Thursday, Baker Hughes reported Haynesville rigs up 7, triggering another reversal. Mar 3.00/2.75 put spreads crossed in huge size at 4.2 cents, and Mar 2.75 puts saw 61,000+ contracts on CME.

4. Back-Curve Vol & The Deferred Bid

While front-month vol was getting crushed, the back of the curve told a different story. JV28 $4.00 calls were lifted at 28.5 cents early in the week. By Wednesday, JV27 was gapping higher on bids with $4.00 calls trading at 31 cents. Cal’28 was going bid across the board. Winter vol and summer ’27 remained well supported even as the front corrected.

5. Storage, LNG & The Structural Puzzle

End-of-season storage estimates have settled around 1.6–1.7 Tcf on the Henry Hub side, with V26 balances at 3.7–4.0 Tcf. The question is whether those levels justify $2-handle targets or whether the market needs to stay elevated. One frustrating dynamic for traders this winter: even when Hub cash was north of $50, LNG barely budged — especially at Venture Global facilities. With SALTs running low and production still not back to pre-rally levels, the structural picture remains complicated even as weather risk fades.

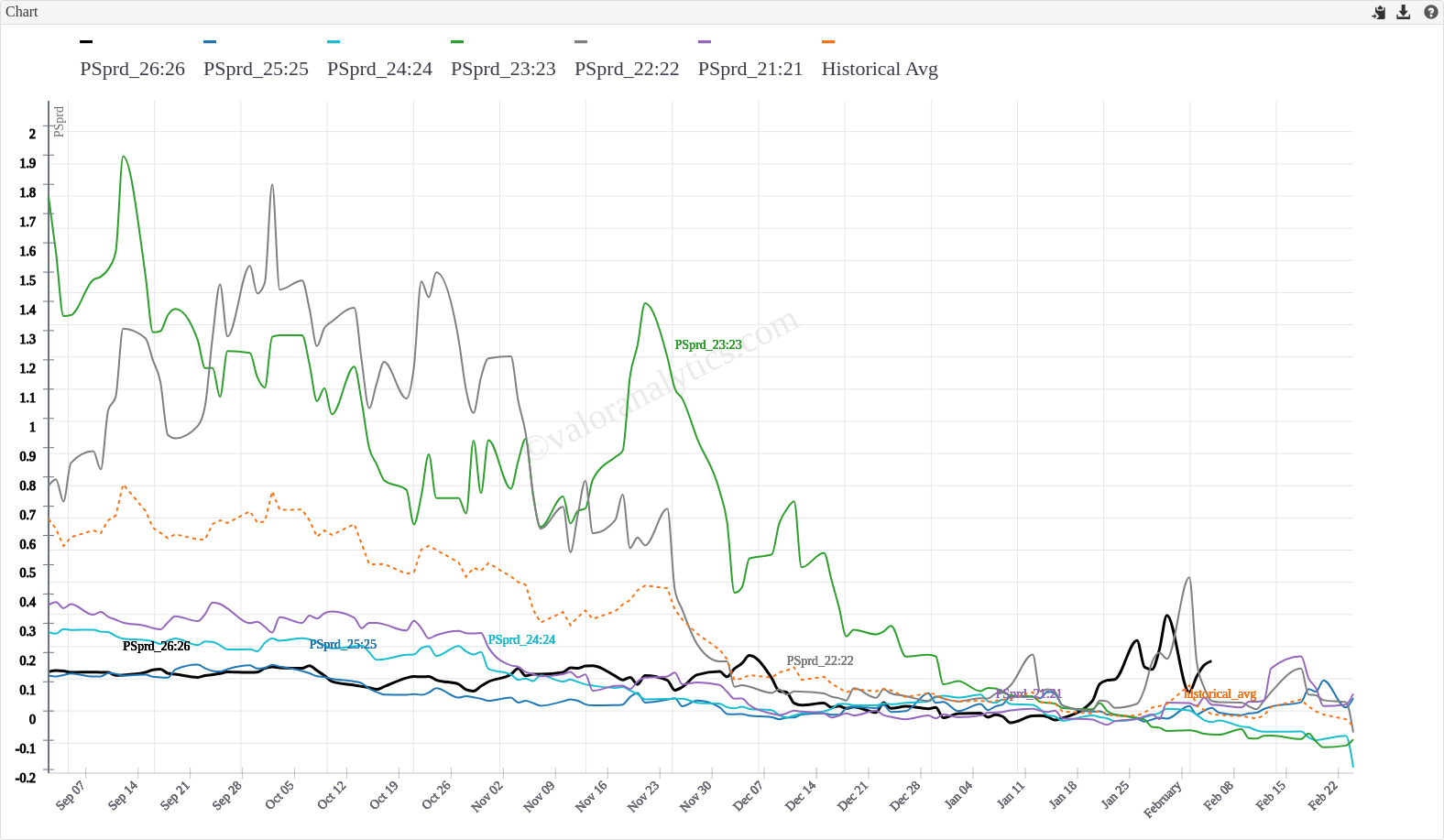

6. Spread Activity

Oct/Jan spreads continued their widening theme. The -2.00/-0.50 fence traded at 3 cents to the puts, and -1.25/-1.50/-1.75 put flies traded at 2.6 cents (a V/F widening to -1.50 trade). Mar/Apr structures and calendar spread options remained active throughout the week as traders repositioned around the new seasonal outlook.

What We’re Watching Next Week

- Weather models: This winter’s pattern has been cold-flip-warm-repeat. Any shift back to cold could reverse the move just as quickly

- March expiry dynamics: With vol crushed, gamma positioning into March expiry will be key. Breakevens are high without weather support

- Back-curve vol: JV27 and Cal28 are seeing real demand. Is this the start of a sustained bid in deferred vol?

- Haynesville production: The +7 rig count already moved the market. Production recovery pace will shape the EoS narrative

- EIA storage: The weekly number will either confirm or challenge the 1.6–1.7 Tcf EoS consensus

Beyond the Surface: What Our Premium Reports Cover

This free weekly recap gives you the narrative — but the real edge is in the data. Our daily Valor View newsletter and VALR EOD Reports provide institutional-grade analytics including:

- 65+ daily charts covering straddle tables, skew progression, vol heatmaps, break-even surfaces, and seasonal overlays for NG, CL, and HO

- Option Matrix with vol changes by both strike and delta — critical for understanding how the skew reshapes on big moves

- Spread analytics (H/J, calendar spreads, CSOs) with historical context and the new Spreads Matrix with fly views

- Vol termstructure analysis showing exactly where the market is pricing risk across the curve

- Intraday volatility tracking across the full term structure

Want the full picture? Subscribe to Valor View for daily market intelligence delivered to your inbox, or reach out to learn about our VALR platform for real-time options analytics.

About Valor Analytics

Valor Analytics provides institutional-grade energy derivatives analytics, market intelligence, and trading tools. Our platforms — OTCEngine and VALR.ai — serve energy trading desks, hedge funds, and commodity firms worldwide.